Does Homeowners Insurance Cover Water Heater Damage? What Duluth Homeowners Need to Know

Picture this: You wake up to find your basement flooded because your water heater has burst overnight. As you stand ankle-deep in water, watching your belongings float by, one question immediately comes to mind: does homeowners insurance cover water heater damage?

The answer isn’t as straightforward as you might hope. While homeowners insurance policies can provide financial protection for certain water heater-related incidents, coverage depends heavily on the cause of damage, your specific policy terms, and whether the issue stems from sudden failure or gradual deterioration.

At J&RS, we regularly help homeowners navigate these complex coverage questions after water heating system failures. Understanding your insurance coverage options before disaster strikes can save you thousands of dollars and help you make informed decisions about protecting your home and family.

Key Takeaways

- Homeowners insurance typically covers water heater damage only when caused by sudden, covered perils like fire, theft, or severe weather

- Normal wear and tear, mechanical breakdowns, and maintenance-related failures are generally excluded from standard coverage

- Insurance may cover property damage caused by water heater leaks but not the water heater repair or replacement itself

- Equipment breakdown coverage can be added to your policy to protect against mechanical failures of water heaters

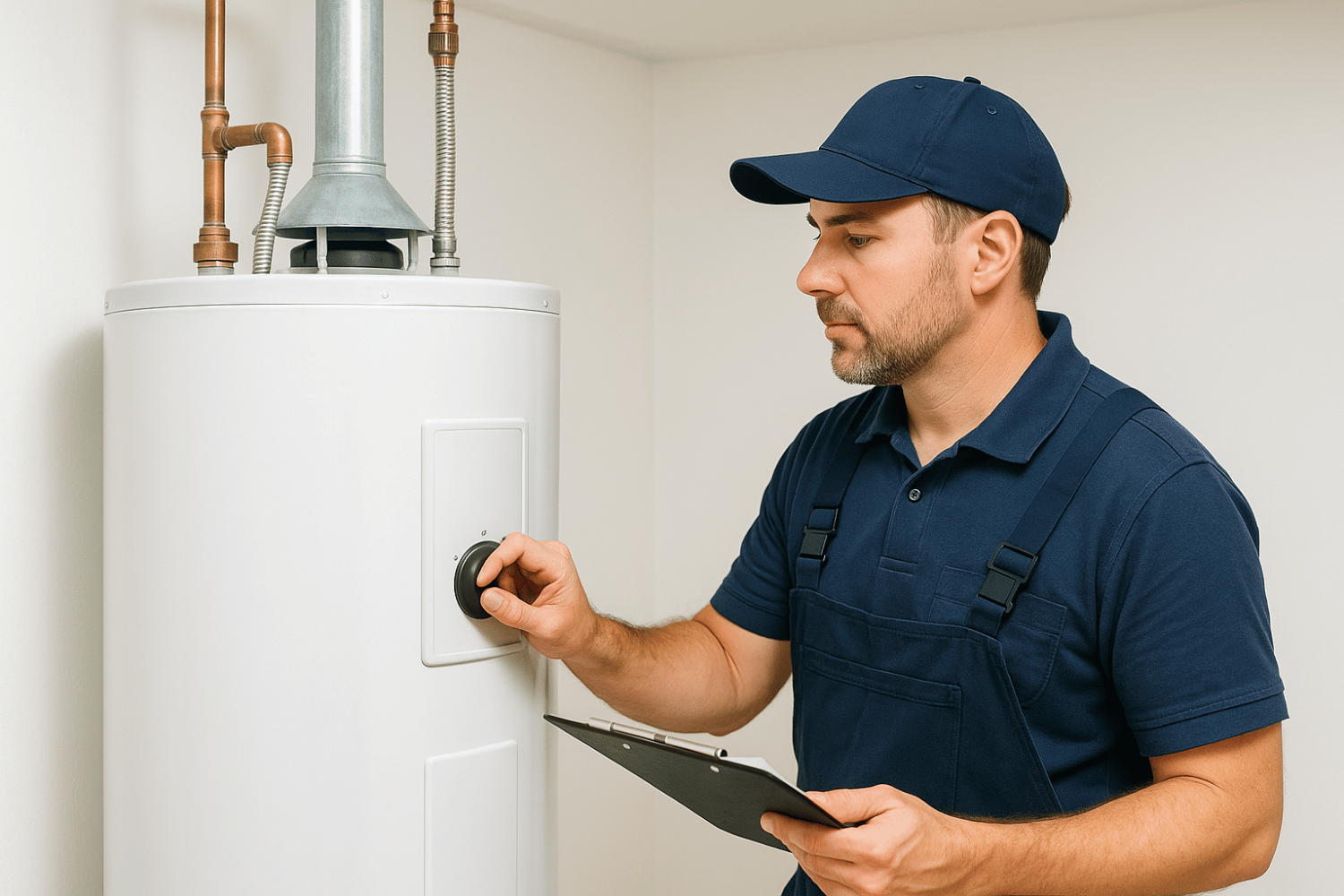

- Regular maintenance and inspections can help prevent damage and potential insurance claim denials

- Understanding your specific policy terms is crucial as coverage varies between insurers and policy types

When Homeowners Insurance Covers Water Heater Damage

Your standard homeowners insurance policy will cover water heater damage under specific circumstances, but understanding these scenarios can help you determine when to file a claim and when to pay out of pocket.

Water Heater Damage from Covered Perils

Insurance companies will pay for water heater damage when it results from sudden, covered perils explicitly listed in your policy. These typically include:

Fire damage represents one of the most clear-cut coverage scenarios. If a fire starts near your water heating system or spreads to involve the unit directly, your insurance company will typically cover both the water heater replacement and any resulting property damage to your house structure and personal belongings.

Storm damage from severe weather events like hail, high winds, or fallen trees can also trigger coverage. For instance, if a tree falls on your garage and damages the water heater inside, your homeowners insurance policies would likely cover the replacement cost under the “other structures” portion of your coverage.

Theft or vandalism of water heater equipment falls under most standard policies. While uncommon, heat pump water heaters and other valuable units might be targeted, especially if they’re installed in detached structures or easily accessible areas.

Lightning strikes that damage the electrical components of your water heating system typically qualify for coverage. This is particularly relevant for modern heat pump water heater units with complex electronic controls that can be destroyed by electrical surges.

Water Heater Damage from Covered Perils

Here’s where coverage gets more interesting for homeowners. Even when your insurance won’t pay to replace the water heater itself, it may still cover the damage caused by the unit’s failure.

When a water heater tank suddenly ruptures and floods your basement, your homeowners insurance will typically cover:

The key distinction lies in understanding “damage to” versus “damage caused by” your water heater. While poor maintenance might exclude coverage for the unit itself, sudden flooding from an unexpected failure often falls within covered property damage, provided the homeowner can demonstrate the event was truly sudden rather than the result of a gradual leak.

When Homeowners Insurance Does NOT Cover Water Heaters

Understanding exclusions in your home insurance policy can save you from unpleasant surprises during claim time. Most standard homeowners insurance policies explicitly exclude several common water heater failure scenarios.

Normal wear and tear represents the most significant exclusion. Water heaters naturally deteriorate over their 8-12 year lifespan, and insurers won’t pay for replacements due to aging components, rust, corrosion, or gradual decline in heating capacity.

Mechanical or electrical breakdowns from regular use fall outside standard coverage. When heating elements burn out, thermostats fail, or pumps stop working due to normal operation, homeowners must cover these repairs themselves.

Poor maintenance issues can void coverage entirely. If sediment buildup, lack of annual inspections, or failure to replace worn components leads to failure, insurance companies may deny claims for both the water heater and resulting damage.

Manufacturer defects and installation problems typically aren’t covered by homeowners insurance. However, these issues might be addressed through manufacturer warranties or contractor guarantees, making it essential to work with reputable plumbing professionals for installation and repairs.

Gradual leaks that develop slowly over time don’t qualify as sudden, accidental events. If water damage results from a small leak that went unnoticed for weeks or months, insurers often deny claims based on the gradual nature of the damage.

Equipment Breakdown Coverage for Water Heaters

For many Duluth homeowners, adding equipment breakdown coverage to their standard homeowners insurance policy provides valuable financial protection against mechanical failures that standard policies exclude.

This optional endorsement typically costs between $25 and $100 annually, depending on your coverage limits and the value of your home’s mechanical systems. When you consider that replacing a standard water heater can cost $1,200 to $3,500, while heat pump water heaters and tankless models can run significantly more money, this additional coverage often pays for itself with a single claim.

Equipment breakdown coverage protects against:

- Sudden mechanical failure of water heating components

- Electrical breakdowns in heat pump water heater systems

- Diagnostic costs to determine the cause of failure

- Emergency repairs needed to restore hot water service

- Replacement of the entire unit when repair isn’t feasible

This coverage also extends beyond water heaters to protect air conditioning systems, heating equipment, and other major household appliances, making it particularly valuable for homes with multiple aging systems.

The claims process for equipment breakdown coverage typically moves faster than standard property damage claims, as insurers recognize that households need immediate restoration of essential services like hot water and heating.

Types of Water Heater Coverage by Insurance Policy

Different insurance policy types offer varying levels of protection for water heating systems, and understanding these distinctions helps homeowners make informed coverage decisions.

Standard homeowners policies provide the broadest coverage for single-family homes. Built-in water heaters are typically covered under dwelling coverage as part of your home’s structure, while units in detached garages fall under “other structures” coverage with separate limits.

Condo insurance creates more complex coverage scenarios. The building’s master insurance policy may cover water heaters that serve multiple units, but individual unit owners are responsible for their dedicated equipment.

Condo owners should verify coverage boundaries with both their insurance agent and building management.

Renters insurance typically doesn’t cover landlord-owned water heaters, but tenants who install their own units need appropriate coverage. Renters should also ensure their personal belongings are protected against water damage from building-owned equipment failures.

The difference between replacement cost and actual cash value coverage significantly impacts claim payouts. Replacement cost coverage pays the full amount needed to replace your water heater with a similar new unit, while actual cash value factors in depreciation. For a 10-year-old water heater, the difference could be substantial, potentially leaving homeowners with significant out-of-pocket costs.

Filing a Water Heater Insurance Claim

When a water heater disaster strikes, quick action and proper documentation can make the difference between a successful claim and a denial.

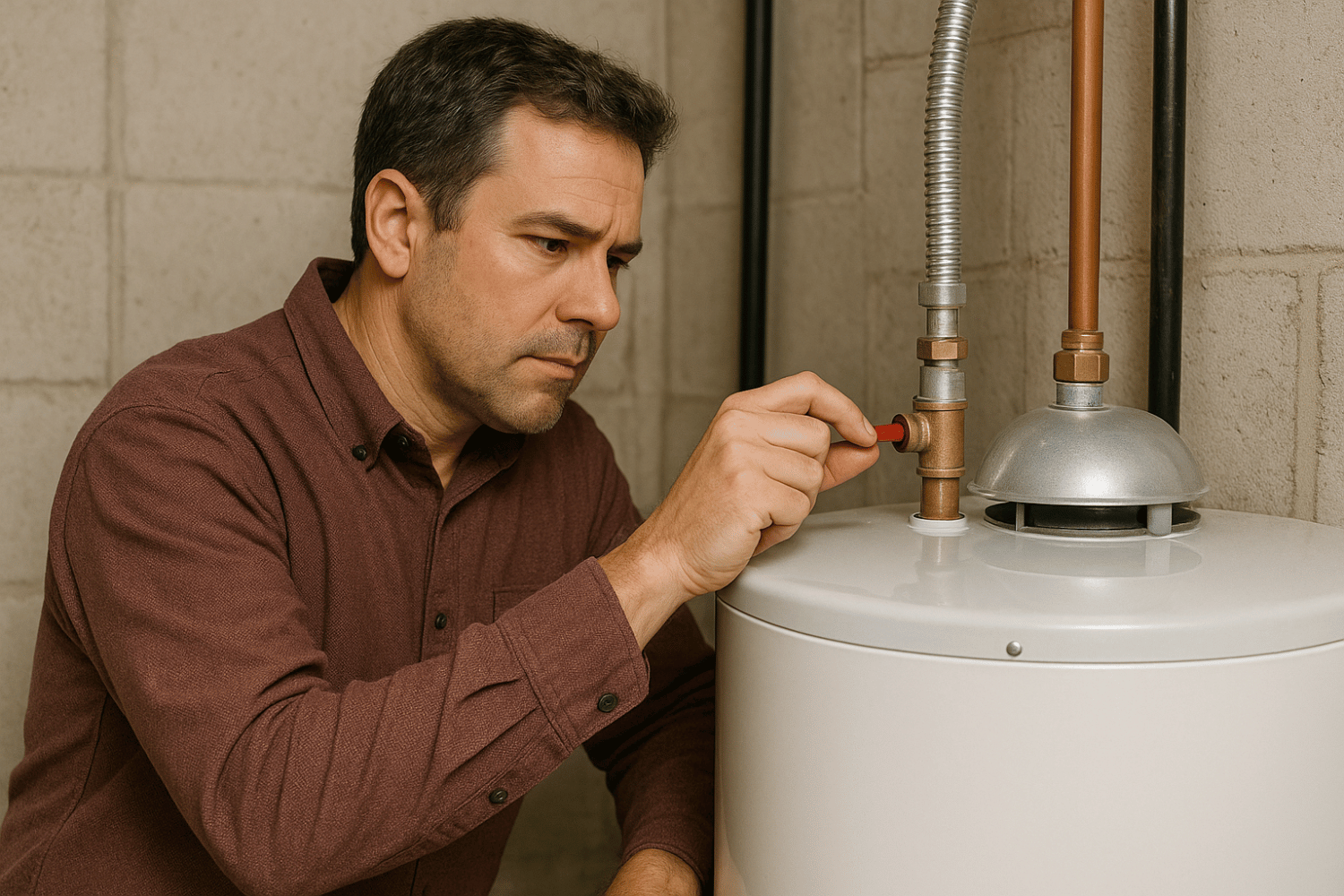

Immediate steps should include shutting off the water supply to prevent additional damage, documenting the scene with photos and videos, and contacting your insurance company within 24-48 hours. Most insurers have specific timeframes for claim reporting, and delays can complicate the approval process.

Documentation requirements typically include:

Working with experienced plumbing professionals during the claims process provides several advantages. Licensed contractors understand insurance requirements and can provide detailed estimates that support your claim. They can also identify whether the failure resulted from covered perils or excluded maintenance issues.

Common claim denial reasons include:

Understanding your deductible amount helps set realistic expectations for claim payouts. If your water heater replacement costs $2,000 and your deductible is $1,500, the net insurance benefit may not justify filing a claim, especially considering potential premium increases.

Preventing Water Heater Damage and Insurance Issues

Proactive maintenance represents the best strategy for avoiding both water heater failures and insurance claim denials. Insurance companies increasingly scrutinize maintenance records when evaluating claims, making documentation essential.

Annual professional inspections should include checking the temperature and pressure relief valve, examining the tank for signs of corrosion, testing the thermostat operation, and flushing sediment from the tank. Professional plumbers can identify potential problems before they become catastrophic failures.

Preventive measures homeowners can implement include:

Documentation practices that support insurance claims include maintaining service records, photographing your water heater annually to show its condition, and keeping receipts for all maintenance and repairs. This paperwork proves you’ve taken reasonable steps to maintain the equipment.

Installing automatic water shutoff systems and leak detectors not only prevents damage but may also qualify for insurance discounts. These devices can detect leaks early and shut off the water supply before significant flooding occurs.

Water Heater Age and Insurance Coverage

The age of your water heating system significantly impacts insurance coverage availability and claim approval likelihood. Most insurers impose restrictions on coverage for older equipment, with thresholds typically beginning at 10-15 years.

- Typical Coverage Restrictions: Full coverage with standard deductibles

- Insurer Requirements: Proof of professional installation

- Typical Coverage Restrictions: Standard coverage, possible inspection required

- Insurer Requirements: Maintenance records may be requested

- Typical Coverage Restrictions: Limited coverage, higher deductibles possible

- Insurer Requirements: Pre-coverage inspection often required

- Typical Coverage Restrictions: Restricted or excluded coverage

- Insurer Requirements: Replacement may be required for coverage

Water Heater Age: 0-8 years

Water Heater Age: 8-12 years

Water Heater Age: 12-15 years

Water Heater Age: 15+ years

New water heater installations often require permits and professional installation to maintain insurance coverage. Working with licensed contractors like JRS Plumbing ensures compliance with local building codes and manufacturer requirements, protecting your coverage eligibility.

Some insurers offer credits or discounts for upgrading to energy-efficient models like heat pump water heaters. These units often include advanced safety features and monitoring systems that reduce the risk of catastrophic failures.

Replacement timing becomes crucial as units approach coverage age limits. Proactively replacing aging water heaters before they fail allows homeowners to maintain coverage and avoid emergency replacement costs during cold Duluth winters when demand for professional services peaks.

Cost Considerations for Water Heater Insurance Coverage

Understanding the financial implications of different coverage options helps homeowners make informed decisions about protecting their water heating investments.

Replacement costs vary significantly based on the type and capacity of your water heating system:

Property damage costs from water heater failures can dwarf the replacement cost of the unit itself. Basement flooding from a burst tank can easily cost $5,000-$15,000 for cleanup, drying, and restoration of damaged building materials and personal belongings.

Equipment breakdown coverage costs between $25-$100 annually for most homes, making it one of the most cost-effective insurance add-ons available. When compared to the potential out-of-pocket expense of emergency water heater replacement, this coverage often pays for itself within the first year.

Deductible considerations play a crucial role in claim decisions. Standard homeowners insurance deductibles range from $500-$2,500, and some insurers apply separate, higher deductibles for water damage claims. Understanding these amounts helps homeowners determine when filing a claim makes financial sense.

The long-term savings from proper maintenance often exceed the cost of annual professional inspections. Preventive care extends water heater lifespan, maintains energy efficiency, and demonstrates responsible ownership to insurance companies.

Summary

Understanding whether homeowners insurance covers water heater damage requires careful examination of your specific policy terms, the cause of any failure, and the distinction between damage to versus damage caused by your water heating system. While standard policies provide limited coverage for mechanical breakdowns, they do protect against property damage from sudden failures and damage from covered perils.

For Duluth homeowners, the combination of harsh winters, aging housing stock, and the critical nature of reliable hot water makes understanding these coverage nuances essential. Regular maintenance, proper documentation, and consideration of additional coverage options like equipment breakdown protection can help ensure you’re prepared for whatever your water heating system might face.

Working with experienced professionals for installation, maintenance, and emergency repairs not only protects your investment but also supports insurance coverage eligibility. When your water heater needs attention, contact J&RS for expert service that keeps your system running efficiently and maintains your insurance protection.

Frequently Asked Questions

Does homeowners insurance cover a 15-year-old water heater that stops working?

Most standard homeowners insurance policies won’t cover mechanical failure of a 15-year-old water heater due to age and wear exclusions. However, if the failure causes sudden property damage (like flooding), that damage may be covered. Equipment breakdown coverage could provide protection for the unit itself, though many insurers have age restrictions for this coverage as well.

Will my insurance cover water damage if my water heater bursts suddenly?

Yes, if your water heater experiences a sudden, unexpected rupture that causes flooding, homeowners insurance typically covers the resulting property damage. This includes water removal, cleanup, and repair of damaged floors, walls, and personal belongings. However, the cost to replace the water heater itself usually isn’t covered unless the burst resulted from a covered peril like fire or lightning.

Is equipment breakdown coverage worth buying for my water heater?

For most homeowners, equipment breakdown coverage offers excellent value at $25-$100 annually. Consider that a new water heater costs $1,200-$3,500 or more, while heat pump water heaters can cost significantly more money. This coverage protects against mechanical failures that standard policies exclude, making it especially valuable for homes with aging equipment or high-efficiency systems.

What should I do immediately if my water heater starts leaking?

First, shut off the water supply to the unit and turn off power to electric units or gas supply to gas units. Document the scene with photos showing the water heater’s condition and any damage. Contact your insurance company within 24-48 hours to report the incident. If flooding occurs, begin water removal immediately to minimize damage, but save receipts for emergency services.

Can I be denied coverage if I don’t maintain my water heater properly?

Yes, insurance companies can deny claims if they determine that lack of proper maintenance caused the failure or resulting damage. Poor maintenance includes failing to flush sediment, ignoring warning signs, or skipping professional inspections. Maintaining service records and following manufacturer recommendations helps protect your coverage.

Does homeowners insurance cover tankless water heater repairs?

Coverage for tankless water heater repairs follows the same principles as traditional tank units. Mechanical breakdowns from normal wear aren’t covered, but damage from covered perils like fire, lightning, or theft typically is. The higher replacement cost of tankless systems makes equipment breakdown coverage particularly valuable for these installations.

How much does it cost to add equipment breakdown coverage to my policy?

Equipment breakdown coverage typically costs $25-$100 per year, depending on your home’s value and the coverage limits you select. This endorsement covers water heaters, air conditioning systems, heating equipment, and other major appliances against mechanical and electrical failures, making it one of the most cost-effective insurance add-ons available.

Will my rates go up if I file a water heater claim?

Filing any homeowners insurance claim can potentially impact your premiums, though the effect varies by insurer and your claims history. Small claims that barely exceed your deductible may not be worth filing due to potential rate increases. However, significant property damage claims are typically worth filing regardless of potential premium impacts, as the financial protection justifies the cost.

Lighting is a key element of kitchen design, impacting both functionality and ambiance. Incorporating task, ambient, and accent lighting enhances the kitchen’s appeal and usability. Maximizing natural light creates an inviting atmosphere.

Choosing appropriately sized light fixtures maintains scale and proportion in your kitchen design. Proper lighting enhances aesthetic appeal and ensures the space is functional for cooking, dining, and entertaining.

A well-thought-out lighting design can transform your dream kitchen into a sophisticated and inspiration-filled space that meets your needs and reflects your personal style. Consider exploring various kitchen design ideas to enhance your space further with paint.

Summary

Remodeling your kitchen is a complex but rewarding process that requires thorough planning and preparation. From setting up a temporary kitchen to tackling potential delays and unexpected costs, each step is crucial for a successful renovation. By following these essential tips, you can create a functional, beautiful, and energy-efficient kitchen that meets your needs and enhances your home.